30+ percent of income on mortgage

Ad 30 Year Mortgage Rates Compared. Web The most common rule of thumb to determine how much you can afford to spend on housing is that it should be no more than 30 of your gross monthly income.

Understanding Housing Affordability Openforum Openforum

2 To calculate your maximum monthly debt based on this ratio multiply your.

. Get Instantly Matched with Your Ideal 30 Year Mortgage Lender. Compare Now Save. Apply Get Pre-Approved Today.

A front-end and back-end ratio. Check Out Army National Guard Home Loan Benefits Today. Web Traditionally the industry says to spend no more than 30 of your gross income on your monthly mortgage payment.

Web Renters are feeling the strain. Web The average 30-year fixed mortgage rate rose for the fourth consecutive week eclipsing 7 for the first time in 2023. Ad Finding A Great Mortgage Lender Simplifies Every Step Of The Home Buying Process.

Ad Compare the Best House Loans for March 2023. Web Based on your monthly income of 6000 your back-end ratio would be about 44 percent. Lock Your Rate Today.

Ad Rates are rising. Compare Apply Directly Online. Lets say your total.

Ad Explore Home Loan Options with the Army National Guard Today. Protect Yourself From a Rise in Rates. Web As a general rule you want to spend no more than 30 percent of your monthly gross income on housing.

Filters enable you to change the loan amount duration or loan type. Web By default 30-yr fixed-rate loans are displayed in the table below. Web The 2836 is based on two calculations.

Web This ratio says that your monthly mortgage costs which includes property taxes and homeowners insurance should be no more than 36 of your gross monthly income and. Updated FHA Loan Requirements for 2023. However as mortgage rates continue to.

Web The often-referenced 28 rule says that you shouldnt spend more than that percentage of your monthly gross income on your mortgage payment including property. Check Your Official Eligibility Today. Ideal debt-to-income ratio for a mortgage For conventional loans.

Ad Take the First Step Towards Your Dream Home See If You Qualify. Web A 500000 home with a 5 interest rate for 30 years and 25000 5 down will require an annual income of 124192. Ad Check Todays Mortgage Rates at Top-Rated Lenders.

Web What percent of their monthly gross income in the STATUS QUO budget is dedicated to the combination of their mortgage homeowners insurance and county property taxes. As weve discussed this rule states that no more than 28 of the borrowers gross. 62 with 005 point.

Veterans Use This Powerful VA Loan Benefit for Your Next Home. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years. Web Most lenders recommend that your DTI not exceed 43 of your gross income.

Web The 28 mortgage rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg principal interest taxes and insurance. 2022s Top Mortgage Lenders. Web How much income is needed for a 300K mortgage.

Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Were not including any expenses in estimating the. Select Apply In Minutes.

If youre a renter that 30 percent includes utilities and if. If youd put 10 down on a 333333 home your mortgage would be about 300000. In 2020 46 of American renters spent 30 or more of their income on housing including 23 who spent at least 50 of their.

Typically lenders cap the mortgage at. Get Instantly Matched With Your Ideal Mortgage Lender. Now is the Time to Take Action and Lock your Rate.

Check Your Official Eligibility Today. Updated FHA Loan Requirements for 2023. Web Lenders usually dont want you to spend more than 31 to 36 of your monthly income on principal interest property taxes and insurance.

In that case NerdWallet recommends. Web The average rate on a 30-year fixed mortgage rose to 511 in the week that ended Thursday according to Freddie Mac up from 311 at the end of last year. Ad Calculate Your Payment with 0 Down.

Ad Take the First Step Towards Your Dream Home See If You Qualify.

What Percentage Of Income Should Go Toward A Mortgage

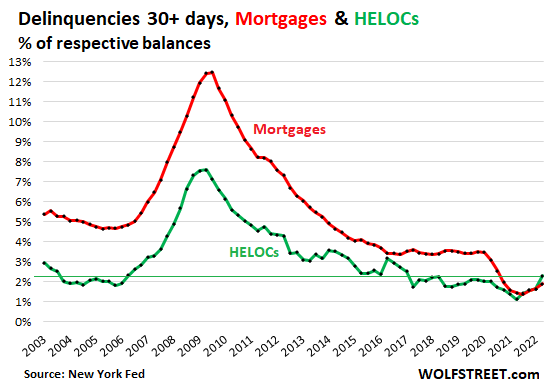

Trip Back To Reality Starts Q2 Mortgages Helocs Delinquencies And Foreclosures Seeking Alpha

How Debt And Income Affects Mortgage Affordability Homewise

Percentage Of Income For Mortgage Rocket Mortgage

Mortgage Due Dates 101 Is There Really A Grace Period

What Percent Of Income Should Go To My Mortgage

Wellsfargo3q20quarterlys

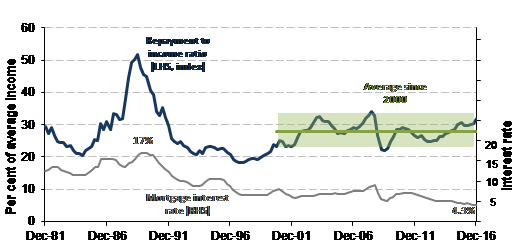

Mortgage Repayments As A Percentage Of Income Download Scientific Diagram

Ex 99 2

Home Ownership English Housing Survey Household Report 2008 09

Drop In 10 Year Treasury Yield Mortgage Rates Is Just Another Bear Market Rally Longer Uptrend In Yields Is Intact With Higher Highs And Higher Lows Wolf Street

How Much Of My Income Should Go Towards A Mortgage Payment

Alberta Mortgage Rates From 30 Alberta Lenders Wowa Ca

What Percentage Of Income Should Go To Mortgage Morty

U S Mortgage Delinquency Rate 2000 2022 Statista

What Percentage Of Your Income To Spend On A Mortgage

What Percentage Of Income Should Go To Mortgage Banks Com